In today’s rapidly developing real estate sector, preserving a competitive edge necessitates more than depending only on instinct and knowledge. It requires adopting a data-driven strategy fueled by real estate data analytics. Whether you’re a seasoned investor, a real estate agent, or a property developer, leveraging data analytics capacities can yield valuable benefits.

By harnessing data analytics, professionals access many insights that exceed traditional analysis methods. It permits them to make instructed findings optimize operations, and enhance profitability. Furthermore data analytics catalyzes facilitating decision-making processes decreasing dependence on subjective estimates, and enabling a more agile and responsive approach to market dynamics.

Adopting real estate data analytics is more than just promising. It’s crucial for success in today’s dynamic real estate landscape.

Understanding Real Estate Data Analytics

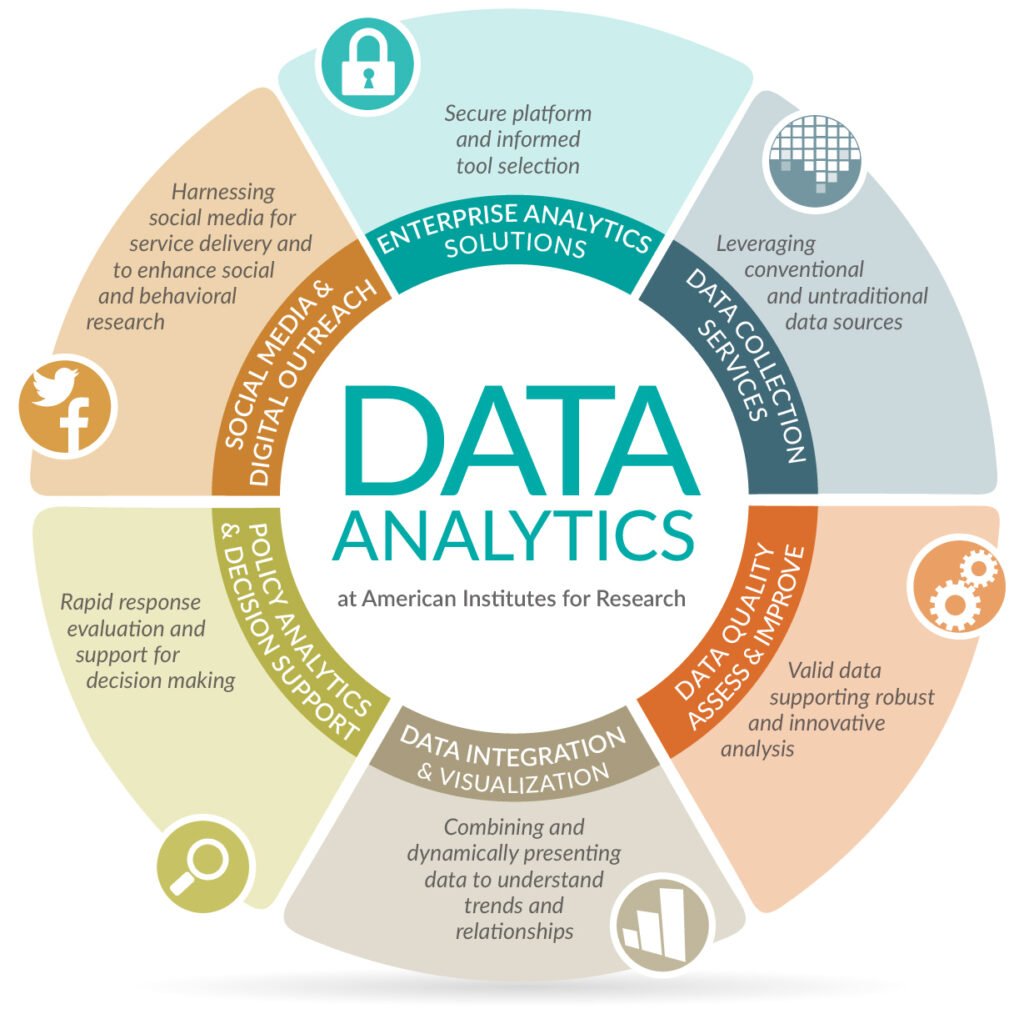

Understanding Real Estate Data Analytics concerns delving into the complex market data analysis world. It involves collecting, analyzing and utilizing different data points relevant to real estate including property listings sales trades demographic information and market trends.

By using advanced analytical techniques such as machine learning and predictive modeling specialists gain insights into existing designs and companies within the market. This experience enables stakeholders to make informed decisions identify lucrative prospects and mitigate risks effectively.

Real Estate Data Analytics is a vital tool for teaching the complexities of the real estate landscape providing valuable insights that drive strategic decision-making and ultimately contribute to success in the industry.

Why Real Estate Data Analytics Matters

Real Estate Data Analytics matters profoundly in today’s real estate industry due to its pivotal role in shaping strategic decisions and driving success. Here are several reasons why it holds such significance:

-

Informed Decision-Making

Real Estate Data Analytics assigns experts to make well-informed settlements by supplying them with actionable insights from comprehensive data analysis. This data-driven approach underestimates reliance on instinct and guesswork, resulting in more precise and practical decision-making procedures.

-

Market Trends and Opportunities

Real estate data analytics allows stakeholders to stay ahead by exploring market trends, design needs, and emerging possibilities. It helps determine untapped markets expect changes in demand, and capitalize on lucrative investment options before they become mainstream.

-

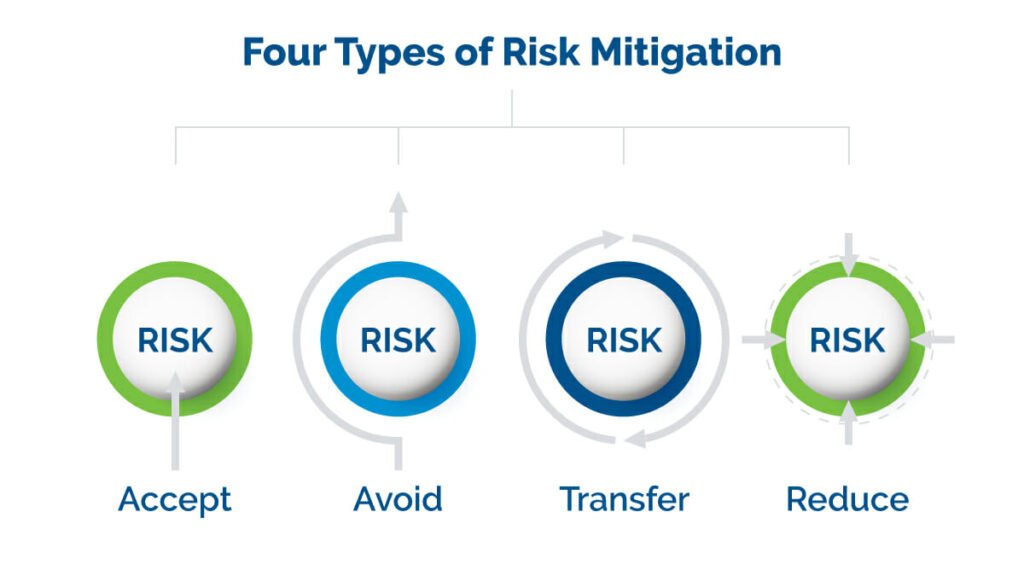

Risk Mitigation

Understanding and reducing risks is essential in real estate investment. Real Estate Data Analytics authorizes experts to assess risk factors like market volatility, regulatory differences, and financial indicators.

By identifying possible risks early on, stakeholders can execute proactive strategies to minimize their effects and protect their assets.

-

Optimized Strategies

Whether it’s pricing effects accurately, optimizing marketing campaigns, or improving operating efficiency, real estate data analytics allows streamlined strategies for the highest effectiveness. Experts can fine-tune their strategy and allocate resources more efficiently by analyzing historical data and undertaking metrics.

-

Competitive Advantage

In a positively competitive market, gaining a competitive edge is essential for success. Real Estate Data Analytics delivers stakeholders a more profound knowledge of market dynamics, customer behavior, and competition strategies. This knowledge allows them to determine themselves, innovate, and stay ahead of their competitors.

How to Use Real Estate Data Analytics Effectively

-

Define Your Objectives

Determining your goals before diving into real estate data analytics is necessary. A straightforward guide is essential in recognizing lucrative investment options, optimizing property arrangements, or mitigating risks.

By communicating your goals upfront, you can focus your analytical efforts and ensure that your plans align with your overarching goals, ultimately driving success in the dynamic real estate landscape.

-

Gather Relevant Data

Collecting pertinent data is crucial for informed decision-making in real estate. It involves sourcing information from reliable sources such as MLS listings, government databases, and industry reports. Data precision and timeliness are essential for deriving meaningful wisdom.

Experts can understand market dynamics, property trends, and investment options by gathering relevant data, laying the basis for strategic decision-making and victory.

-

Utilize Analytical Tools

Incorporate analytical tools into your real estate toolkit to enable data analysis and decision-making processes. These tools, from technical software platforms to customizable dashboards, offer vital elements such as predictive modeling, market segmentation, and data visualization.

By exploiting these tools, specialists can gain deeper insights into market trends, property implementation, and investment options. This authorizes them to make informed decisions with certainty and precision, ultimately driving success in the competitive real estate landscape.

-

Analyze Market Trends

Exploring market trends is essential for guiding the intricacies of the real estate landscape. Professionals gain insights into existing market needs by analyzing supply and market dynamics, pricing changes, and customer preferences.

It allows them to make educated decisions, predict shifts in demand, and identify emerging opportunities. Staying up-to-date on market trends, stakeholders can virtually adapt their strategies to capitalize on growing market dynamics.

-

Identify Investment Opportunities

Investment possibilities are crucial in real estate industries. Using data analytics and market wisdom, experts can identify lucrative prospects with pledging returns. It concerns analyzing market trends, evaluating property performance, and assessing potential risks.

By recognizing opportunities early and performing through due persistence, investors can make informed decisions that align with their investment objectives and maximize profitability in the active real estate landscape.

-

Mitigate Risks

Mitigating risks is paramount in real estate ventures. By recognizing potential threats such as financial downturns, regulatory changes, or property-specific problems, experts can execute proactive efforts to minimize their influence.

Strategies may include diversifying portfolios, ensuring insurance coverage, or performing thorough due perseverance. This risk-comfort approach protects investments, enhances stability, and promotes long-term peace in an unexpected market environment.

-

Optimize Marketing Strategies

Enhancing marketing strategies is essential in real estate. Professionals can reach their target audience and push attention by optimizing processes such as targeted promotion, social media attention, and personalized campaigns.

Analyzing customer behavior and market trends permits the improvement of marketing actions to resonate nicely with possible buyers or tenants. This optimization increases visibility and leads and enhances overall brand perception and customer satisfaction.

-

Track Performance Metrics

Monitoring performance metrics is crucial in real estate endeavors. By following key indicators such as occupancy rates, rental yields, and sales volumes, professionals achieve insights into the efficacy of their strategies and the general health of their investments.

They analyze these metrics over time permits for declared decision-making, enabling adjustments as required to optimize performance and maximize returns on investment.

Conclusion

In today’s forcefully competitive real estate market, the importance of harnessing data analytics cannot be magnified; it’s a requirement for success. As the industry becomes more complicated and dynamic, experts must leverage available data and develop analytical methods.

By doing so, stakeholders can remove valuable insights that notify decision-making, mitigate risks, and find untapped opportunities. Real estate data analytics is a beacon of advice in guiding the ever-evolving landscape, offering a strategic advantage to those who adopt it.

In essence, it’s not just about staying applicable; it’s about proactively placing oneself to succeed amidst changing market dynamics. Therefore, assuming real estate data analytics today is not merely a suggestion but a demand for staying forward of tomorrow’s turn.

FAQs

[sp_easyaccordion id=”2136″]